AUDACIA

Financing visionaries and pioneers

Audacia is the realization of the vision of its founder, Charles Beigbeder, to provide effective, visionary, and specialized support to entrepreneurs who aspire to drive ambition and growth. It is an independent management company specializing in private equity.

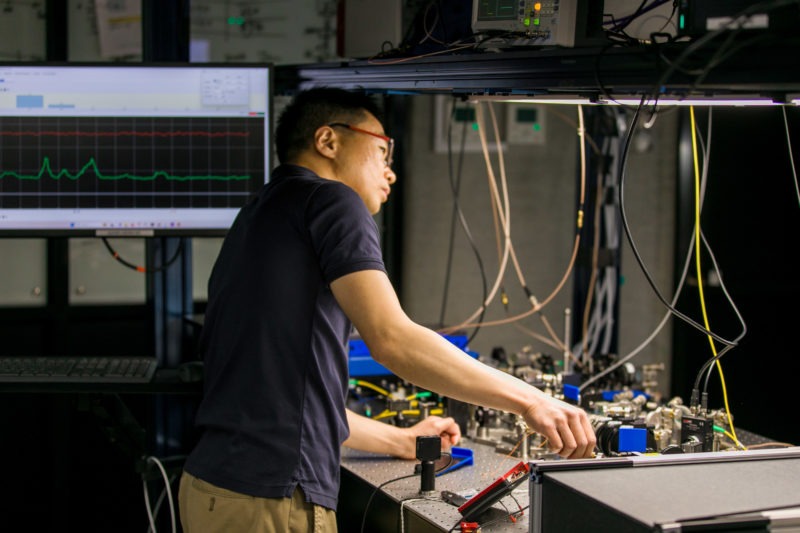

With this goal in mind, Audacia has always supported entrepreneurs with disruptive projects facing equity financing needs: from entrepreneurial SMEs in its original activity, to the emergence of new branches in deeptech, and finally, to the reinvention of shared living spaces. These opportunities are structured into three areas of expertise: Growth Capital, Venture Deeptech, and Real Estate.

Since 2006, Audacia has invested over €950 million in more than 400 companies.

Through our specialized model, we have built sophisticated ecosystems, fostering interactions among stakeholders: entrepreneurs, financiers, experts, and decision-makers.

We distinguish ourselves by our ability to be specialized minority investors, often being the first financiers to stand alongside an entrepreneur. We combine equity and quasi-equity in the most effective way to support development projects at various stages of growth.

We provide access to these projects as innovative and diversified investment solutions for private investors, family offices, and institutional clients, all in pursuit of maximising returns.